The decline in U.S. stock prices hurt Berkshire Hathaway Inc’s (BRKa.N) second-quarter earnings. The conglomerate run by billionaire Warren Buffett disclosed a $43.8 billion loss on Saturday. CEO Buffett advises investors to disregard the volatility because if stock prices grow over time, Berkshire will profit.

The decline in the price of U.S. stocks had a negative impact on the bottom line of Berkshire Hathaway Inc. (BRKa.N) during the second quarter. On Saturday, the conglomerate that is run by billionaire Warren Buffett reported a loss of $43.8 billion. Berkshire also slowed down its acquisitions of equities, including the company’s own. This was despite the fact that it still had 105.4 billion dollars in cash available for deployment.

How the Berkshire offset fresh losses worth billions

Despite this, Berkshire was still able to generate an operating profit of nearly $9.3 billion thanks to contributions from reinsurance and the BNSF railroad. These contributions helped to offset fresh losses at the Geico auto insurer. The auto insurer’s losses were caused by a shortage of parts and higher prices for used vehicles. The increase in accident claims also added to the losses tally.

Insurance companies were able to produce more money from investments thanks to increasing interest rates and dividend distributions. Along with that the strengthening of the United States Dollar helped raise profits from investments in European and Japanese debt.

James Shanahan analyses Berkshire’s performance

James Shanahan, an analyst at Edward Jones & Co. told Reuters that “The results show Berkshire’s resilience”. The reputed analyst gave a “neutral” rating for Berkshire. This was in spite of the fact that the company’s net loss was enormous.

He stated that despite increased interest rates, inflation pressures, and geopolitical concerns, the businesses are functioning well. He thus added that if there is a recession, he will still have faith in the company because of this.

Investors look into the conglomerate’s other operating units

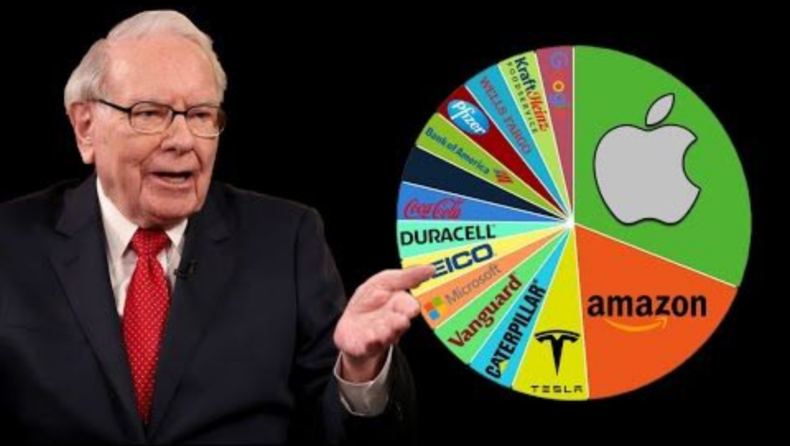

Investors pay close attention to Berkshire because of the stellar reputation of its CEO, Warren Buffett. The fact that the results of the Omaha, Nebraska-based conglomerate’s dozens of operating units frequently match broader economic trends, had also caught their eye.

These units include well-known consumer brands like Dairy Queen, Duracell, Fruit of the Loom, and See’s Candies in addition to reliable revenue generators like the energy company that bears the firm’s name, various industrial enterprises, and others.

Berkshire’s quarterly report

Berkshire stated in its quarterly report that “significant disruptions in supply chains and higher costs have persisted” as a result of the emergence of new COVID- 19 versions. Along with this due to the fact that geopolitical crises, such as Russia’s invasion of Ukraine, the inflation has persisted.

The prices for supplies, shipping, and labor have been increasing. However, it was stated that there have not been any significant direct losses.

Berkshire’s $53 billion in losses from investments and derivatives had a negative impact on the company’s net profits. These losses included decreases of more than 21 percent in three key holdings: Apple Inc. (AAPL.O), Bank of America Corp., and American Express Co. (AXP.N).

Even if it buys and sells nothing, the accounting requirements compel Berkshire to declare its losses alongside its financial results.

CEO Buffet’s message to Berkshire’s investors

The company’s CEO Warren Buffett encourages investors to disregard the gyrations. He stated that Berkshire stands to gain financially if share prices go up in the long run.

For example, Berkshire suffered a loss of nearly $50 billion in the first quarter of the year 2020 as the epidemic began to take root. However, the company ended the year with a profit of $42.5 billion.

Berkshire only repurchased its own stock for a total of $1 billion, which is significantly less than the $3.2 billion it spent during the first quarter. This is significantly less than the $51.7 billion it had to spend for 2020 and 2021.

Read more: Investors consider dumping stocks, is a worldwide recession approaching?