According to persons familiar with the situation, China is considering buying or boosting holdings in Russian energy and commodities corporations such as gas giant Gazprom PJSC and aluminium manufacturer United Co. Rusal International PJSC.

According to the persons, Beijing is in discussion with its state-owned corporations, including China National Petroleum Corp., China Petrochemical Corp., China Aluminum Corp., and China Minmetals Corp., about future spending in Russian companies or assets.

Any agreement would be to boost China’s imports as it focuses more on energy and food security, rather than as a show of support for Russia’s invasion of Ukraine, according to the people.

The talks are still in the initial stages and are unlikely to result in a settlement, according to the people, who asked to remain anonymous because the talks aren’t open to the public. According to separate sources, some conversations between Chinese and Russian energy businesses have begun.

According to the firms’ media representatives, CNPC and China Petrochemical (also known as Sinopec Group) declined to comment. Requests for comment from China’s state asset regulator Sasac, Aluminum Corp. of China, and Minmetals were not immediately returned.

During a national holiday in Russia, representatives for Gazprom and Rusal declined to comment.

The cost of energy, metals, and food has skyrocketed to unprecedented heights as a result of Russia’s war in Ukraine, putting further pressure on Beijing to secure supplies.

Concerned about the economic impact of rising prices, China’s senior government officials issued directives last week to emphasize commodity supply security, according to Bloomberg.

Despite a large business migration from Europe and the United States, China has pledged to maintain normal trading relations with Russia. BP Plc, Shell Plc, and Exxon Mobil Corp. surprised the energy world by turning away from billion-dollar Russian assets.

Meanwhile, China’s Foreign Minister Wang Yi stated earlier this week that the country’s ties with Russia are “rock strong,” despite Beijing’s worry about civilian losses and desire for peace negotiations to end the conflict.

CNPC owns a 20 per cent share in the Yamal LNG project and a 10% stake in Arctic LNG 2, while Cnooc Ltd. also owns a 10% stake in Arctic LNG 2.

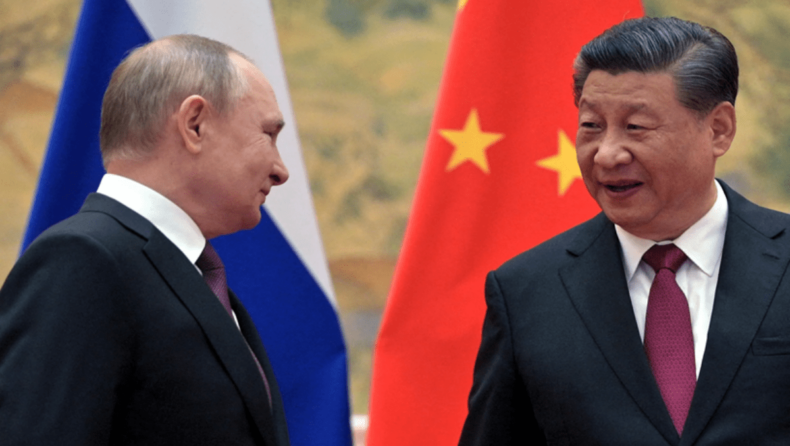

President Xi Jinping and Vladimir Putin had already been tightening ties, signing a series of agreements last month to increase Russian gas and oil supplies, as well as wheat. As the two leaders met in Beijing ahead of the Winter Olympics, Russian energy titans Gazprom and Rosneft PJSC signed agreements.

Nonetheless, any investment in Russia carries risks that go beyond Beijing’s geopolitical balancing act.

As the country’s economy steadily deteriorates, Russia has become an almost uninventable market for international companies. As default risks grow, sanctions have erased billions of dollars from Russian assets and bonds have fallen.

The yuan has risen against the ruble, prompting concerns about both countries’ strategic ties. China’s investment might bolster Moscow’s efforts to speed the so-called “Pivot to Asia” through oil and gas supply agreements.

Over the previous five years, China has nearly increased its purchases of Russian energy supplies to nearly $60 billion.