The recent disclosure of this technology transfer coincides with China’s ongoing efforts to promote chiplet technology, which began approximately two years ago. This information was revealed through an analysis conducted by Reuters, which examined numerous patents from both the United States and China, as well as Chinese government procurement documents, research papers, grants, and interviews with Chinese chip industry executives. Additionally, local and central government policy documents were also taken into account during the analysis.

According to industry experts, this technology has gained even greater significance for China due to restrictions imposed by the United States, preventing access to advanced machinery and materials necessary for producing state-of-the-art chips. As a result, technology has become a cornerstone of China’s strategy for achieving self-sufficiency in semiconductor manufacturing.

Chipuller’s chairman, Yang Meng, expressed in an interview with Reuters that chiplet technology places the United States and China on an equal starting line in terms of competition. However, he acknowledged that there is a notable gap between China and countries such as the United States, Japan, South Korea, and Taiwan in other areas of chip technology.

A recent review conducted by Reuters indicates that chiplets were given relatively little attention before 2021. However, Chinese authorities have increasingly emphasized chiplet technology in recent years. The review found that at least 20 policy documents issued by local and central government entities specifically mentioned chiplets as a crucial component of China’s broader strategy to enhance its capabilities in “key and cutting-edge technologies”.

Charles Shi, a chip analyst at brokerage Needham, explained that chiplets hold significant importance for China, especially considering the restrictions on wafer fabrication equipment. He believes that China can overcome these restrictions by focusing on developing 3D stacking and other chiplet technologies. Shi considers this strategy as part of a larger plan that has the potential to succeed.

In Beijing, chiplet technology is being rapidly leveraged across various applications, ranging from artificial intelligence to self-driving cars. Noteworthy entities, including tech giant Huawei Technologies and military institutions, are exploring the utilization of chiplets.

China’s Chiplet Advantage

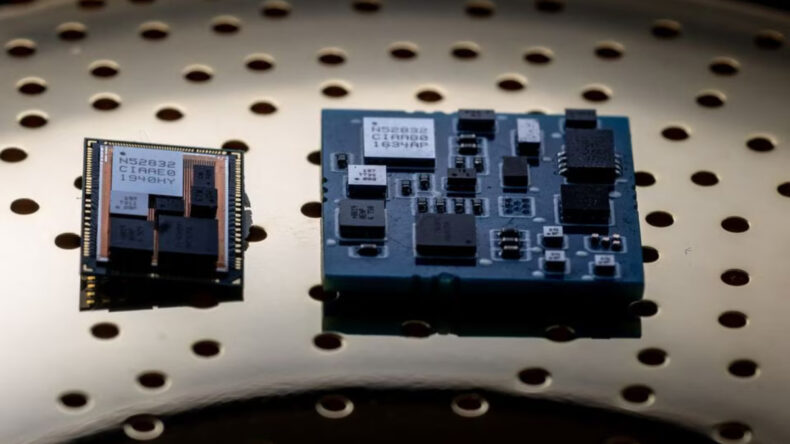

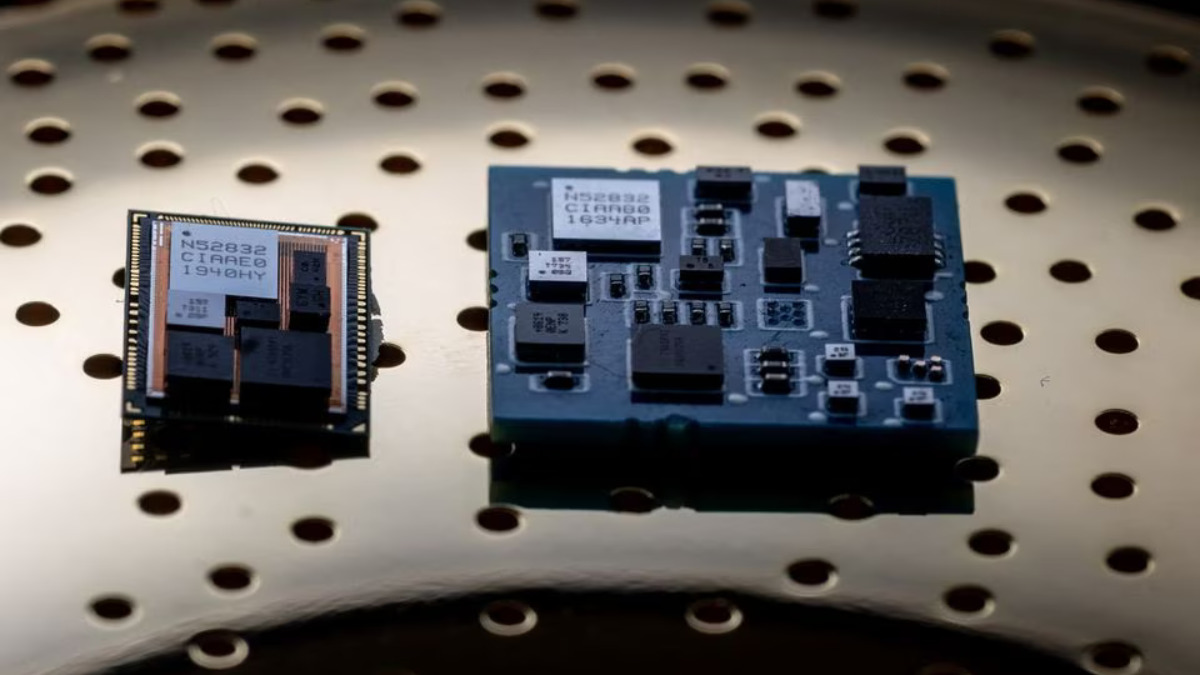

Chiplets, which can vary in size from as small as a grain of sand to larger than a thumbnail, are combined through advanced packaging techniques. This technology has gained increasing popularity within the global chip industry in recent years, primarily driven by rising manufacturing costs and the pursuit of creating smaller transistors measured in atomic scales.

By tightly bonding chiplets together, it becomes possible to develop more powerful systems without the need to further shrink the transistor size. This approach allows multiple chips to function collectively, resembling a unified processing unit.

Notable companies such as Apple, Intel, and AMD have integrated chiplet technology into their high-end computer lines and more robust processors.

According to Dongguan Securities, approximately one-fourth of the global chip packaging and testing market is situated in China.

While some argue that China has an advantage in utilizing chiplet technology, Yang Meng, the chairman of Chipuller, cautioned that the proportion of China’s advanced packaging industry is relatively small.

Yang highlighted that under favorable conditions, chiplets customized to meet customer requirements can be swiftly produced, providing China with a unique advantage that allows for completion within three to four months.

Import data from China’s customs agency, as shared by Needham’s Charles Shi, indicates a significant increase in China’s purchase of chip packaging equipment. In 2021, the value soared to $3.3 billion, surpassing the previous high of $1.7 billion in 2018. However, due to a downturn in the chip market, the figure fell to $2.3 billion last year.

Research papers on chiplets have emerged since early 2021, authored by researchers affiliated with the Chinese military People’s Liberation Army (PLA) and the universities it operates. State-run and PLA-affiliated laboratories have also expressed interest in using domestically produced chiplets, as indicated by six tenders published in the past three years.

Government documents reveal significant grants awarded to researchers specializing in chiplet technology, amounting to millions of dollars. Additionally, numerous smaller companies have emerged throughout China in recent years to cater to the domestic demand for advanced packaging solutions, including chiplets.