China has become the third-largest business in Unilever, with strong growth potential ahead. Recently China’s growth declined in the property market and exports. This has affected Unilever in China, the maker of Dove soap and Ben & Jerry’s ice cream, and a widely ranging skin and hair care products.

Despite the early predictions of a ‘consumption boom’, Unilever recovered in the second quarter of Financial Year 2024, with double-digit growth. Temporarily, the historic low in the consumer sentiments of China has increasingly shifted its demand towards Southeast Asia, particularly Thailand and Vietnam.

Economic Regression

China is facing a hard time in terms of its economy. Consumers recently need to be more certain about their financial prospects due to stagnant incomes and a weakened economy. High unemployment issues among the Youth, the Chinese Government’s crackdown on debt-financed property, reduced demand for exports and the negative impact of the Zero-Covid policy made Beijing drop all the restrictions implied by the strategy almost completely to improve the imports and promote a consumption strategy to boost the economy after a heavy regression. All the factors have made consumer confidence drop to the lowest level.

Unilever Financial Analysis

Previous Years

In the results of 2021, Unilever China witnessed a double-digit growth led by the volume of sales, with widely ranging across its categories and retail channels, especially in E-Commerce.

In FY 2020 and 2021, Unilever brands claimed a winning share position in various products like hair care, skincare and Fabric Cleansing categories, both in virtual and person-to-person mode. The Foods retail channel of Unilever doubled in size from 2019 to 2021. The second Quarter Financial Year 2022 reflected single-digit growth.

Unilever’s Business-to-Business foods division, Unilever Food Solutions, was thriving in China in 2020 and 2021, delivering strong growth and doubling in size.

Current Year

Unilever reported that this year the underlying sales growth in China rose by high single digits, similar to the second quarter of 2022, but later on started to recover in the second quarter by double-digit growth, in comparison to a less satisfactory figure which was impacted by heavy lockdown policy.

Unilever recently reported Earnings, beating the underlying sales growth forecasts after the company raised the prices of its products to offset the higher company costs which thus in turn sent the share prices of the company even higher.

Q3 2024 digit Analysis

The immense growth of the business was witnessed across all the business groups.

9.1 % was the underlying sales growth.

9.4 % was the price growth.

€30.4 Billion was the company’s turnover.

Strategy by Unilever

Economic shifts in China have resulted in the on-and-off growth of the economy. Government policies, Covid and other business factors took a huge toll on the economy, which needs to be given some time to get back on track. According to the survey, it will take time for consumers to switch back to premium products and the hair care and skin care life.

Innovation

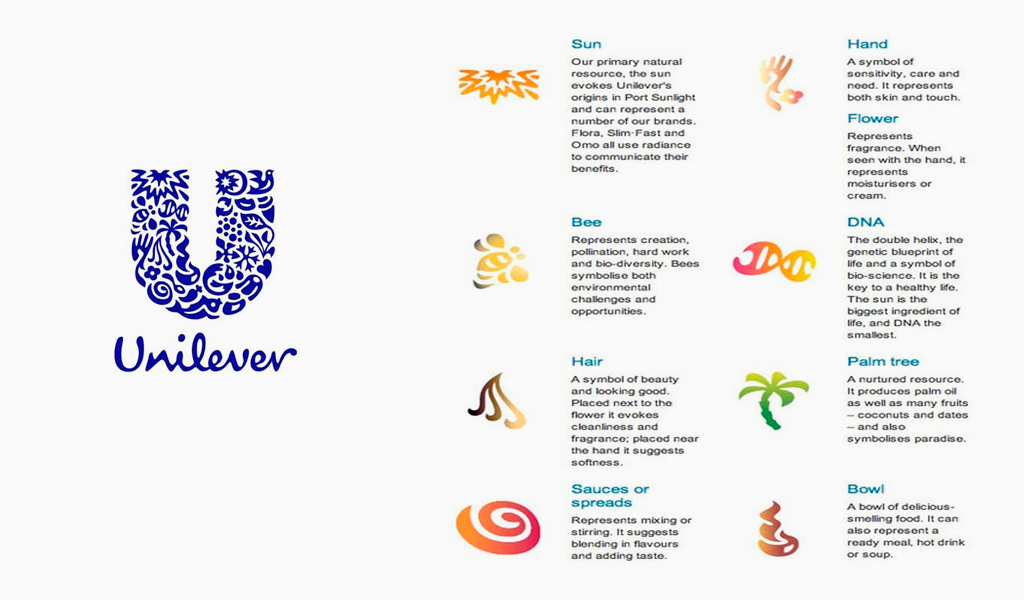

Innovation is what Unilever believes it needs now. In 2021, the introduction of the new premium Pro derma Vaseline range, got all the customers to spend lavishly on it which plummeted the sales of the product instantly.

Virtual Mode

Online Shopping channels and E-Commerce can be a fruitful step initiated by the Unilever company in provoking more sales. As it’s the era of virtuality.

This will help in boosting advertisements, sales and brand growth.

Segmentation

The segmentation of the traditional brick-and-mortar retail store channels into individual segments such as the supermarket, Grocery shops, hypermarkets, specialist beauty outlets and much more, will lead to a wider awareness of the products.