Image Courtesy – PayTmBusiness.

The Unified Payments Interface which is famously called (UPI) is a smartphone application that permits clients to transfer money between bank accounts. UPI is a single-window versatile payments system created by the National Payments Corporation which is also known as (NCPI). It dispenses with the ought to enter bank points of interest or other delicate data each time a client starts a transaction.

Image Courtesy – India.com.

Indians voyaging overseas can presently pay outside merchants via UPI in UAE, Singapore, Nepal and Bhutan. Advanced instalment company PhonePe on Tuesday propelled its ‘UPI international’ payments feature, making it the primary fintech within the nation to empower cross-border UPI payments.

The UPI payments can be made to outside dealers within the said nations, given they have a nearby QR code. Rather than universal debit cards, clients can make UPI payments with outside cash from their Indian bank.

PhonePe clients ought to enact their UPI-linked account for the UPI International feature, either at the vendor location or earlier to their trip. The users will at that point need to enter their UPI stick to actuate the service.

Image Courtesy – BusinessToday.

India’s most effective payments framework UPI will be utilized in France, Prime Minister Modi stated whereas tending to the Indian community in Paris.

“India and France have chosen to use UPI in the upcoming days. It will be started from the Eiffel Tower, which will prescribe Indian Visitors to pay in rupees” PM Modi said, suggesting the Bound together Payments System, or UPI.

Allowing UPI in France will open up gigantic conceivable outcomes within the way Indians can

spend. UPI will be able to do absent with awkward forex cards and maintain a strategic distance from the got to carry cash to spend.

Image Courtesy – NewKerela.

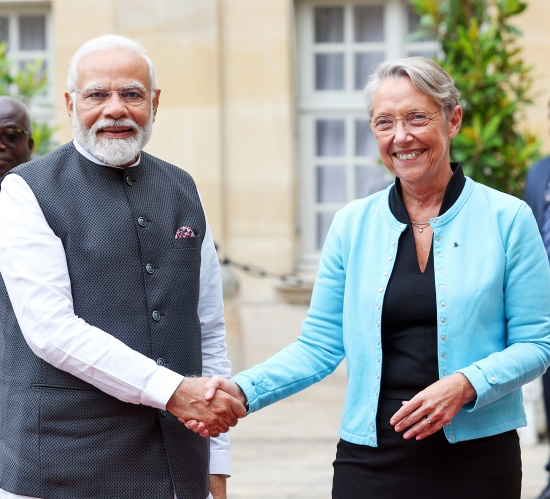

PM Modi started his France visit with “productive” gatherings with his French PM Elisabeth Borne and Senate President Gerard Larcher, amid which he talked about ways to confer unused driving force to India’s multifaceted participation and time-tested key organization with the key European nation.

The declaration is seen as a critical advancement for reciprocal exchange and tourism between India and France. PM Modi too expressed that the two nations are working on archaeological missions for a long time.

He too focused on the people-to-people interface between France and India, saying that it is the “most grounded establishment” of the organization between the two nations, ANI detailed.

In this developed way, at this urgent time where everyone is fighting their own battles, the centrality of the imperative organization between our countries has extended more,” PM Modi included.

Image Courtesy – OneIndia.

India’s UPI powers numerous bank accounts into a single versatile application (of any taking an interest bank), consolidating a few keeping money highlights, consistent support directing and shipper instalments into one hood. It too caters to “peer to peer” collect-ask, which can be planned and paid as per prerequisite and convenience.

The National Payments Corporation of India (NCPI) conducted a pilot dispatch with 21 part banks in April 2016. Since that point, UPI utilization has seen colossal development. Indeed vendors acknowledge UPI instalments for as small as ₹ 5 or 10 for a container of tea.

Highlighting India’s changing part within the worldwide observer, Modi said: “Today, the world is moving towards a present-day world observation. The capability and the part of India is changing fast. Currently, India is the president of G20. It’s for the essential time, in a country’s organization, that more than 200 social occasions are being held over the nation.”