Lithium EVs have been on trend for quite some time now as fuel prices rise and concern for climate change is growing. Lithium batteries are the primary energy source for EVs, but can the EV industry keep up with the huge rise in demand for lithium as a clean source of power?

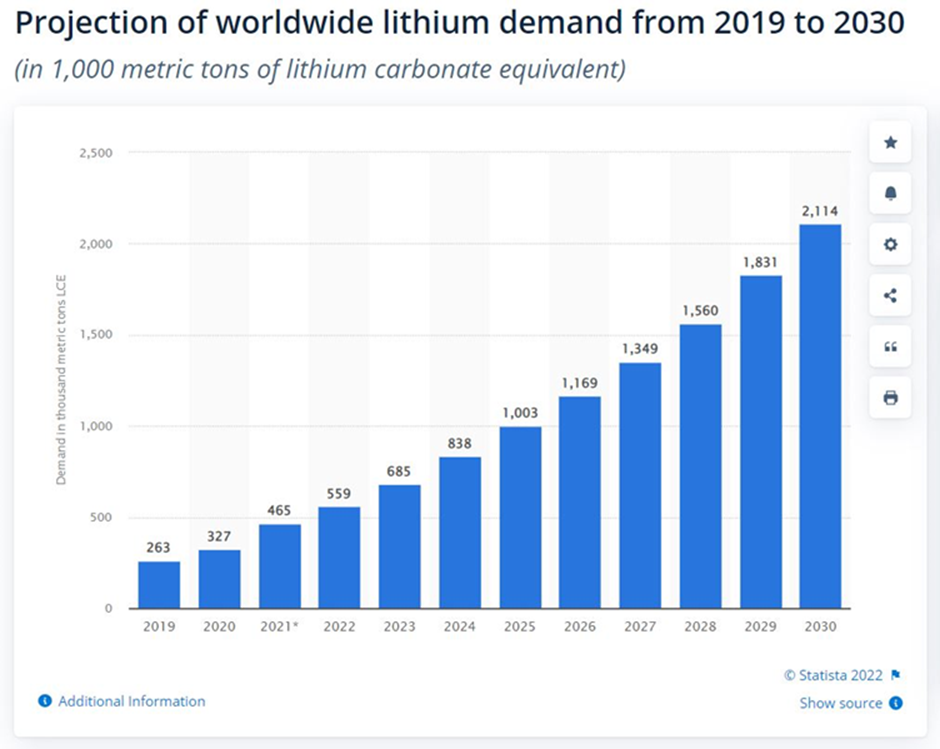

There have been many reports worldwide about the industry not being able to keep up with demand, which in turn has increased the price of lithium tenfold over the past two years. The IEA has said that by 2025 the world could face a lithium shortage and demand for lithium could treble in the coming years, which means that the supply of lithium would be stretched

The likely shortage of lithium for EVs in the coming decade could lead to a transition from lithium to hydrogen fuel cells for vehicles like luxury cars and larger vehicles.

The UK government has given its support to the Advanced Propulsion Centre (APC) to help the automotive industry to accelerate its transition to net zero.

In its previous report, it has been said that the rapid adoption of EVs could be the cause of a lithium shortage. It also stated that the deficit could drive up prices because supply would be limited and that consumers would most likely opt for next-generation batteries, such as fuel cell EVs (FCEVs).

According to the APC research, EV and other automobile makers and suppliers should be prepared to “mitigate” due to supply shortages and try to diversify their powertrain choices in the near to medium term.

Other proposals included producing BEVs with smaller batteries, replacing lithium with sodium-ion batteries in specific cars, and transferring BEV manufacturing to FCEVs, plug-in hybrid EVs (PHEVs), and range-extender vehicles.

Because battery technology is best suited to lighter cars, the centre estimates that as many as three-quarters of existing larger vehicles and premium models might transition to alternative powertrains, with roughly half transitioning to hydrogen fuel cells. The report also said that it would be plausible for luxury models that are short on production.

The centre said that half of the vehicles like SUVs, delivery vans, and four-wheel drives would switch away from batteries, and around a fifth of these vehicles would switch to hydrogen.

The report also foresaw an increase of 6% in hydrogen fuel cell vehicles produced in the UK by 2030, and if the calculations are correct, then it would be 1% nearer to the current forecast if compared to Europe and the rest of the world.

Several car manufacturers are currently developing hydrogen fuel cells, but if we look at British roads, you’d mostly see bus companies that have adopted hydrogen as their fuel.

Wrightbus is a company in Northern Ireland that supplied 20 hydrogen-powered double-decker buses to the West Midlands to carry passengers last December. It also signed a similar deal in January with another company, Go-Ahead (a bus operator).

The Stagecoach Group PLC (LSE: SGC) and Ricardo PLC (LSE: RCDO) launched a pilot scheme which received £2.5 million to switch a double-decker diesel bus to a hybrid fuel cell system bus to drive on local routes.

Companies like Johnson Matthey PLC (LSE: JMAT) in the UK are planning to scale up the manufacturing of hydrogen fuel cell components in Hertfordshire, where they will build an £80 million gigafactory.

The UK government has supported this initiative through the Automotive Transformation Fund (ATF), which is managed by the APC. This new plant will be able to manufacture 3GW of proton exchange membranes (PEM) annually for hydrogen vehicles’ fuel cells. The APC awarded Ceres Power Holdings PLC £7 million in funding in 2018 to collaborate with Nissan on fuel cell technology. The project’s goal is to hasten the commercialization of the UK company’s SteelCell fuel cell technology in the automotive sector. For its fuel cell technology, Ceres has also attracted several other significant partners, including Bosch in Germany, Doosan in Korea, and Weichai in China.

APC also funded Jaguar Land Rover to test and see how the Range Rover cars would run with hydrogen as their fuel.

The automotive sector has several listed hydrogen specialists like AFC Energy PLC, which makes electrolysers and fuel cell systems. In June, Scotland’s AMTE Power PLC signed an agreement to support the development of hydrogen fuel cell vehicles with powertrain developer Viritech. While Powerhouse Energy PLC and Hydrogen Utopia International PLC (AQSE: HUI) are considering initiatives to convert trash to hydrogen, ATOME Energy PLC is concentrating on the Paraguayan transportation industry.