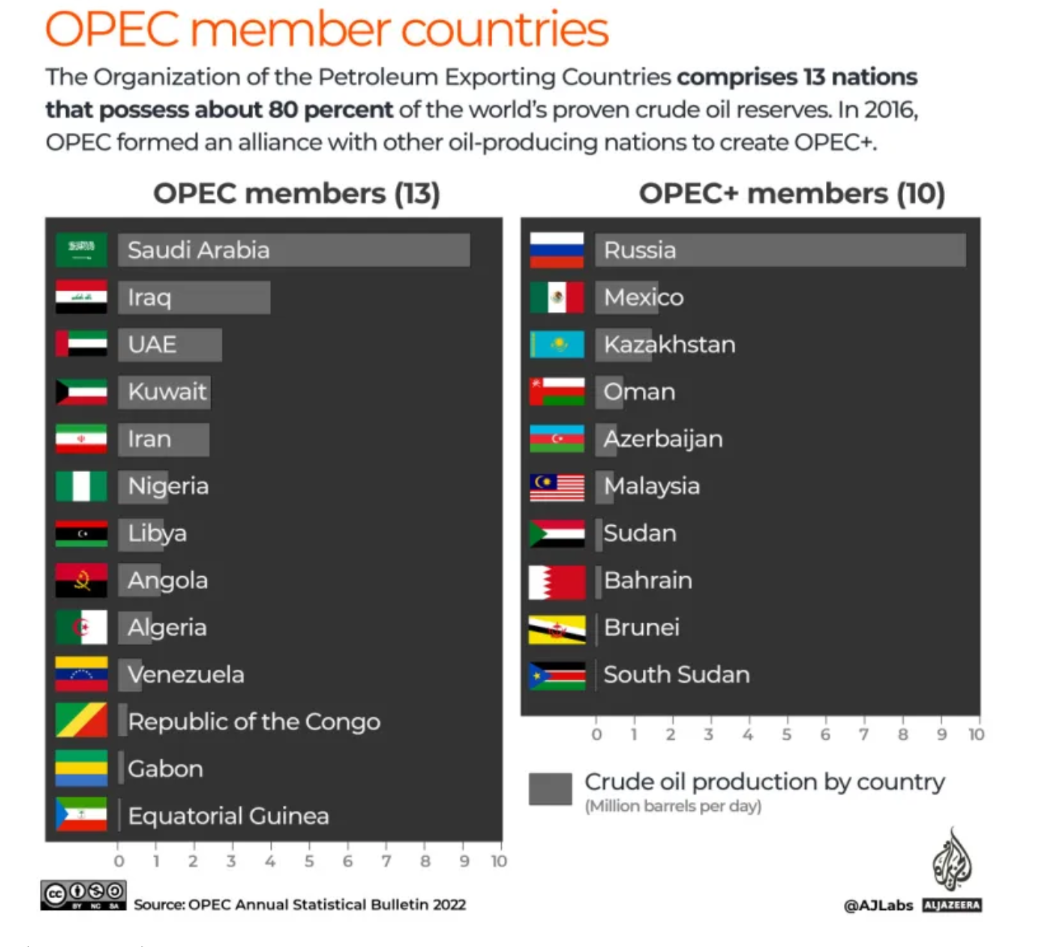

The remaining OPEC+ oil-producing nations have decided to prolong the previously implemented reductions in production until end of 2024

Source : AlJazeera

Table of Contents

In an effort to address falling prices and prevent a potential oversupply, Saudi Arabia announced its decision to reduce output by one million barrels per day (bpd) starting in July. This move comes as the OPEC+ alliance, comprised of major oil-producing countries, faces challenges in stabilizing crude prices. The kingdom’s decision follows previous unsuccessful attempts by OPEC+ members to boost prices through production cuts.

The OPEC+ alliance, which includes the Organization of the Petroleum Exporting Countries and other oil-producing nations led by Russia, held lengthy discussions at its headquarters in Vienna to determine its output policy. After seven hours of negotiations, the group reached an agreement to extend previous cuts in supply until the end of 2024, resulting in a combined reduction of 1.4 million bpd.

With Saudi Arabia responsible for a significant portion of the world’s supply, this decision to further cut production signals the country’s commitment to stabilizing crude prices. The move aims to counter the emerging threat of a global oversupply of oil, which could drive prices even lower. By reducing its exports, Saudi Arabia hopes to support the struggling market and prevent a further decline in oil prices.

This development within the OPEC+ alliance underscores the challenges faced by major oil producers in managing supply and demand dynamics. The decision to extend production cuts and Saudi Arabia’s additional reduction in output demonstrate the collective efforts to address the current market conditions and ensure stability in the global oil market.

Saudi Energy Minister Abdulaziz bin Salman expressed his satisfaction with the agreement reached by the OPEC+ alliance, describing it as a momentous occasion due to its unprecedented quality and transparency. He also stated that Saudi Arabia’s production cut could be extended beyond July if necessary. However, some of the announced reductions will not have a real impact as the production targets for Russia, Nigeria, and Angola were adjusted to match their current output levels.

In contrast, the United Arab Emirates was granted permission to increase its production. As OPEC+ accounts for 40 percent of global crude oil production, its decisions significantly influence prices. The alliance already implemented a 2 million bpd cut in 2022 and a surprise voluntary reduction of 1.6 million bpd starting in May 2024 until the end of 2024.

The recent reduction in production could potentially result in an increase in prices and subsequently lead to higher petrol prices. However, there remains uncertainty regarding when the global economy, which is currently growing at a slow pace, will fully recover its demand for fuel, both for travel and industrial purposes.

Uncertainty Of Outcome With Oil Revenue

The Saudi Arabian government is heavily reliant on sustained high oil revenue to finance its ambitious development projects, which are designed to diversify the country’s economy away from oil. According to the International Monetary Fund, the kingdom requires oil prices to reach $80.90 per barrel in order to fulfill its planned spending commitments, including the Neom project—an innovative desert city endeavor costing $500 billion.

While oil-producing nations depend on revenue to support their national budgets, they must also consider the repercussions of elevated prices on countries that consume oil. Excessively high prices can contribute to inflation, depleting consumers’ purchasing power and prompting central banks like the US Federal Reserve to consider raising interest rates further.

Heightened interest rates are intended to combat inflation, but they can hinder economic growth by making it more challenging for individuals and businesses to obtain credit for purchases or investments.

The current production cut may potentially drive prices upwards, impacting petrol prices. However, the global economy’s revival in terms of fuel demand remains uncertain. Saudi Arabia requires substantial oil revenue to finance its ambitious diversification projects, while oil-producing countries must balance revenue needs with the potential negative effects of high prices on consumers. Excessive prices can lead to inflation, prompting central banks to consider interest rate hikes, which can in turn hinder economic growth by restricting credit availability.