The Yoga celebration on Wednesday, according to organizers, the Prime Minister Modi-led Yoga celebration at the UN headquarters set a Guinness World Record for having participants from the most different nations. President Joe Biden and First Lady Jill Biden invited Modi to come here for the first leg of his first state visit to the US, and he accepted. Modi presided over an important ceremony to celebrate the 9th International Day of Yoga at the UN Headquarters in this city, which was attended by leading diplomats, UN officials, and notable figures.

Behind the well planned ceremonies are conversations that could not only revitalize India-US relations but also have an effect on the international system. The US may need India’s influence in the Indo-Pacific region more than anywhere else at the moment.

The US has long seen India as a tick on China’s expanding regional clout, but Delhi has never been entirely at ease with the label. China is still one of the primary catalysts for advancing relations between India and the US, despite its continued reluctance to do so.

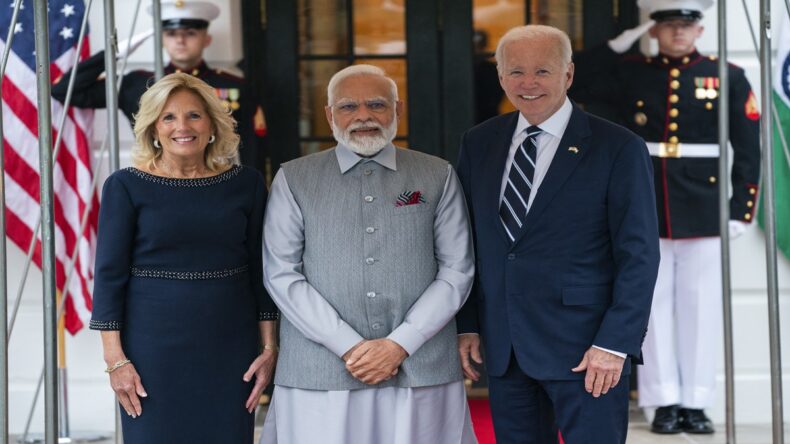

During the visit, Mr. Modi will have talks with President Biden. (Credits: Getty Images)

More is promised by PM Modi’s visit

There was no better time for Prime Minister Narendra Modi to visit the US. As he promotes the country’s potential to American corporate executives and investors, a booming economy, record-high equity benchmarks, and a quickly expanding consumer market all make for fantastic advertisements.

After meeting with PM Modi, Tesla Inc.’s CEO Elon Musk predicted that the company will make a large investment in India. Ray Dalio, the founder of Bridgewater Associates, was also urged to increase his investments in the nation. During Prime Minister Modi’s visit, a contract to supply engines for Indian fighter jets will be signed between General Electric Co. and Hindustan Aeronautics.

After speaking with stock and fixed-income investors in London, Citigroup Inc. analysts Samiran Chakraborty and Baqar Zaidi said in a report this week that “investors concur that India is moving through a ‘Goldilocks’ phase.

Nevertheless, concerns are inevitable. India’s resurgence in spending could be derailed by a delay in the monsoon rains, which are essential for inflation and growth. Furthermore, Indian stocks, which have been hailed as one of the primary beneficiaries of the rotation away from China, could suffer from a quick rebound in China, where equity values have dropped to levels that some money managers find impossible to ignore.