Table of Contents

In recent years, as Fintech has become increasingly popular and mainstream, a lot of people have turned to cryptocurrency as one of the biggest contributors for their income, with Bill Gates even calling it the ‘technological Tour de force’.

However, there is a great amount of skepticism centered around the same too. A big catalyst to this was the elaborate FTX scam which shook the market in 2022 causing a loss worth billions of dollars.

The worst part about these scams is that, unlike other crimes, crypto related financial frauds have no assurance of being retaliated. This is due to the lack of set laws in many nations including ours, however, that seems to be changing now…

India capitalized on the G20 Presidency to break its silence on crypto.

So far different parties had conflicting points of view when it came to online trading of cryptocurrencies.

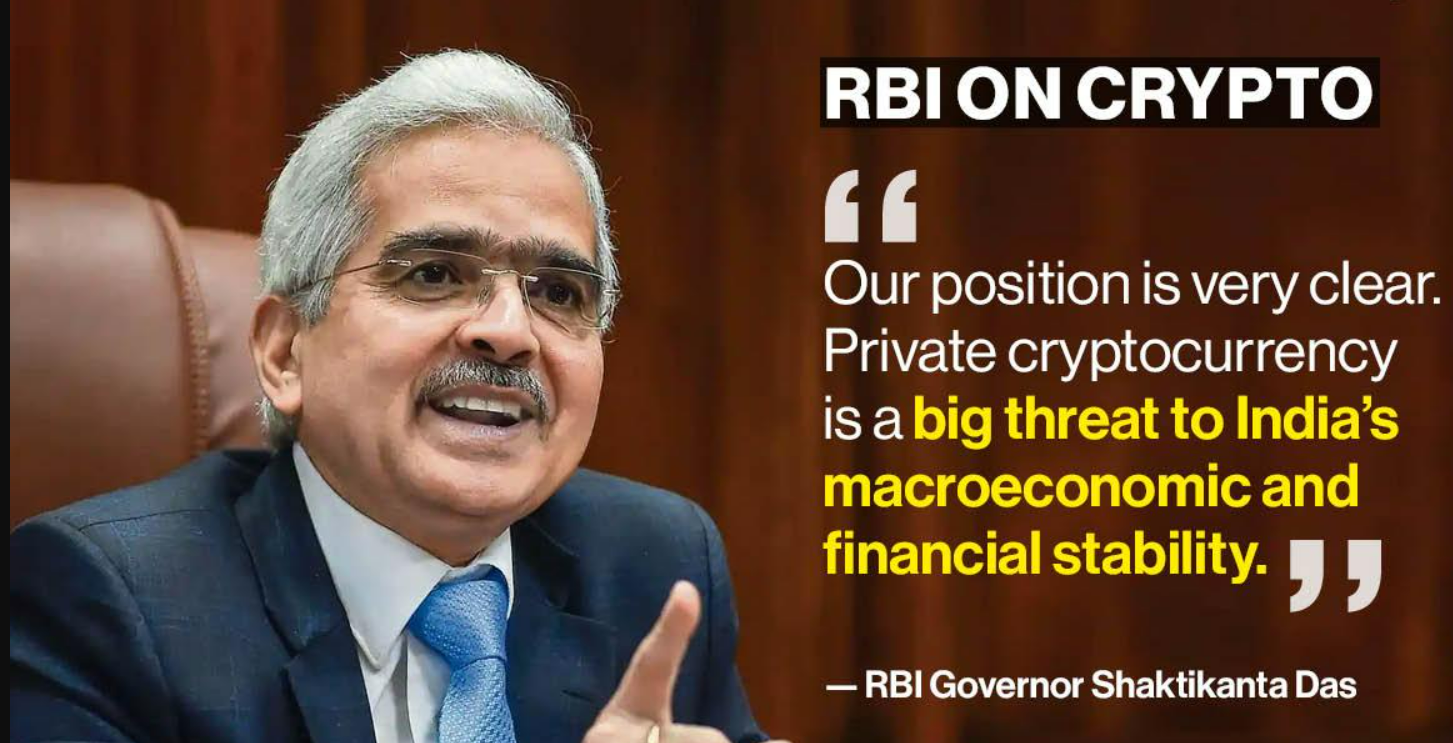

Shaktikanta Das, the RBI governor has been very vocal about his skepticism coining crypto as gambling in some ways. His concern is that virtual monetary deals happen between private companies only, with no monitoring from the government, hence flourishing of cryptocurrency could take away control from the RBI leading to illegal exchanges of all sorts.

On the other hand, the Union Finance Minister ,Nirmala Sitharaman ,has acknowledged the importance of cryptocurrency for the evolution of the nation and the potential it holds if used rightly. She leaned more towards regulation than absolute ban of digital currencies.

However, this was always just a debate and a conflict of views, there was always a sense of vagueness around the subject which was addressed in the ongoing G20 meetings.

India has urged for cooperation from the IMF and FSB.

Preparations have started for a set bill on cryptocurrency for the nation, with insights being taken from several parties including the nations of the G20 as well as international bodies FSB (Financial Stability Board) and IMF (International Monetary Fund) .The synthesis paper of the technical document will be submitted in September.

The US is also actively participating in this venture. Sitharaman co chaired meetings with 2 eminent figures, US Treasury Secretary, Janet Yellen and Managing Director for IMF, Kristalina Georgieva. Both meetings had contradictory tones.

While Yellen established US’ stance against the ban on crypto while revealing America’s ongoing collaboration with other governments on the same topic, Georgieva was all for strict ban, voicing the amount of chaos that could follow. So far nothing has been officially announced about whether the country will ban or reduce regulation, recent events hint at the latter.

What makes the IMF the perfect consultant for our technical document?

At the start of this month the International Monetary Fund released a list of suggestions for cryptocurrency regulation which might be the basis of India’s bill.

The suggestions include:

- Licensing and authorisation of Crypto Asset Providers.

- Any party carrying out more than one function to be subjected to external scrutiny and more through procedures. (major inspiration for this was the FTX failure which exhibited how big of a loss mixing of asset handling and market influence caused.)

- Stablecoins (cryptocurrencies that have their market value pegged to some external entity eg. Tether)to be monitored closer than ever. This is due to the threat of them illegally being used as actual physical money illegally.

- Requirement of transparency from financial trading organizations

What lies ahead?

We will have to wait for September for the technological bill for confirmed clauses; however the theme of the document will be along the lines of global policies and suggestions from the IMF, FSB and other nations.

The possibility of a ban is still not out of the picture…in fact the general Indian public is not that happy with the encouragement for regulation that is being exhibited by the Union.

A lot of people are concerned that cryptocurrency is a more western concept, if not well studied and dealt with, it could take some serious blows on the nation’s economy. Majority of the population is yet to understand the concept of Bitcoin and now is not the time to experiment with something having such high stakes.

Conflicting views (mostly from Indian Investors) argue that to reach the developed nation mark we cant hold back from technological advances because of lack of risk taking and regulation is a middle ground perfect for both scenarios.