The RBI in its monetary policy meet of June 6-8 is likely to announce a rate pause today. The repo rate currently stands at 6.5%

The June meet of the Monetary Policy Committee (MPC) of Reserve Bank of India (RBI) is likely to end today with the RBI expected to announce a rate pause. The RBI had held repo rate in the April meet at 6.5% after 6 consecutive rate hikes.

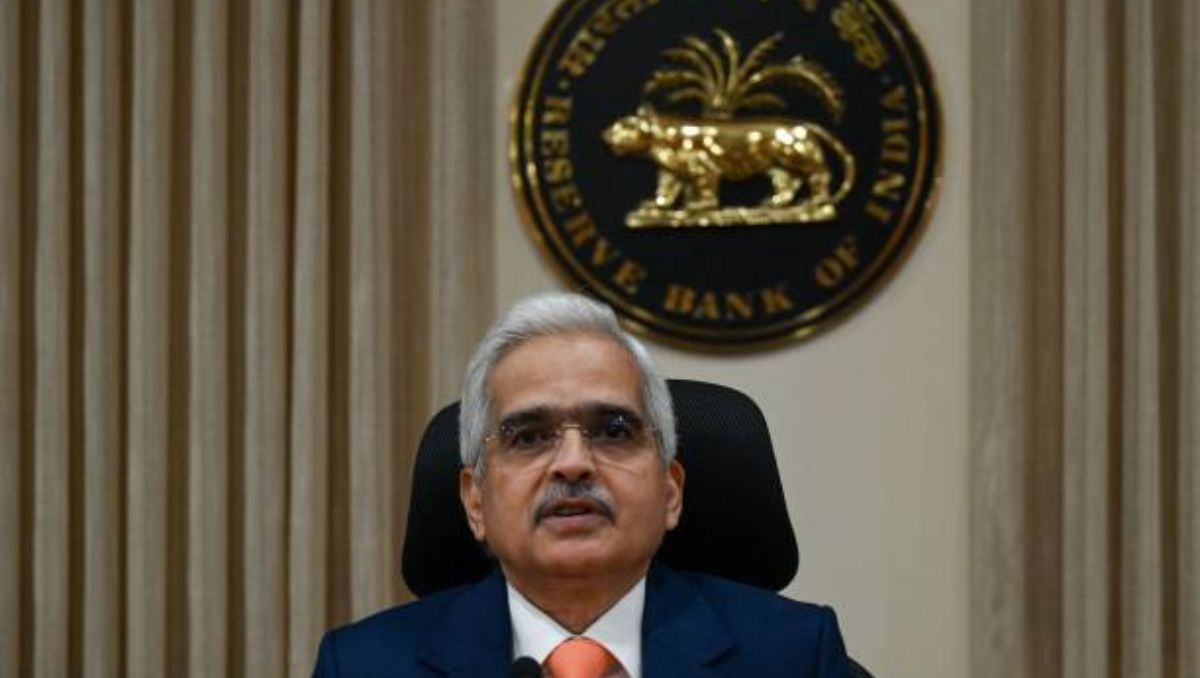

The RBI is set to conclude the MPC today which happened after 2 long months with a rate pause on the cards. The announcement will be made by RBI governor Shaktikanta Das today who is the chair of the MPC.

When the April meet had ended, the MPC members were reluctant to use the word ‘pivot’ and focused more on a rate ‘pause’. This makes the economists and analysts forecast that a rate pause is more likely than a rate pivot.

Why a rate pause is expected?

The MPC members unexpectedly chose to hold the repo rates in their April meet. For the first time since the RBI started increasing the repo rate in May 2022 to control inflation, the repo rate, which is the rate at which the RBI lends money to other banks, was paused in April. However, according to RBI Governor Shaktikanta Das, it was only a pause and not a pivot, and he has since repeated this claim. Since February 2022, the RBI has increased the repo rate by 250 basis points.

According to Abheek Barua, Chief Economist at HDFC Bank, the RBI will continue with the withdrawal of accommodation business until they are confident that food risk of inflation and El Nino are over. Indranil Pan, chief economist at Yes Bank says that due to the evolving growth inflation mix, RBI is likely to pause rate in June.

What does inflation data say?

Consumer price index-based inflation, also known as retail inflation, has decreased since the April policy. It decreased from 5.7 per cent in March to 4.7 per cent in April, below the RBI’s comfort level of 2 to 6 percent for two consecutive months. Additionally, India’s gross domestic product (GDP) increased by 6.1% in the January–March 2024 quarter, which raised the forecast of growth for the entire year (2022-23) to 7.2%. The RBI is expected to preserve the status quo in the June policy, according to experts, given the relaxation of inflation and good GDP growth.

The RBI estimated real GDP growth for FY2024 at 6.5% during the April meet. For FY24, it forecasted CPI inflation to be 5.2%. While the RBI is not anticipated to change its forecast for real GDP growth on the current policy, it may lower its projection for inflation.

Why a rate cut is unlikely?

Neither the markets nor the economists are expecting a rate cut. After the April meet, none of the MPC members seemed to call the pause a pivot and expressed the decision to be a rate pause.

On the other hand, the Federal Reserve in the United States is also set for a June meet on June 13-14, where economists are also expecting a rate pause. The Fed has been increasing the federal funds rate for 10 consecutive meet which stands at 5.25% today.