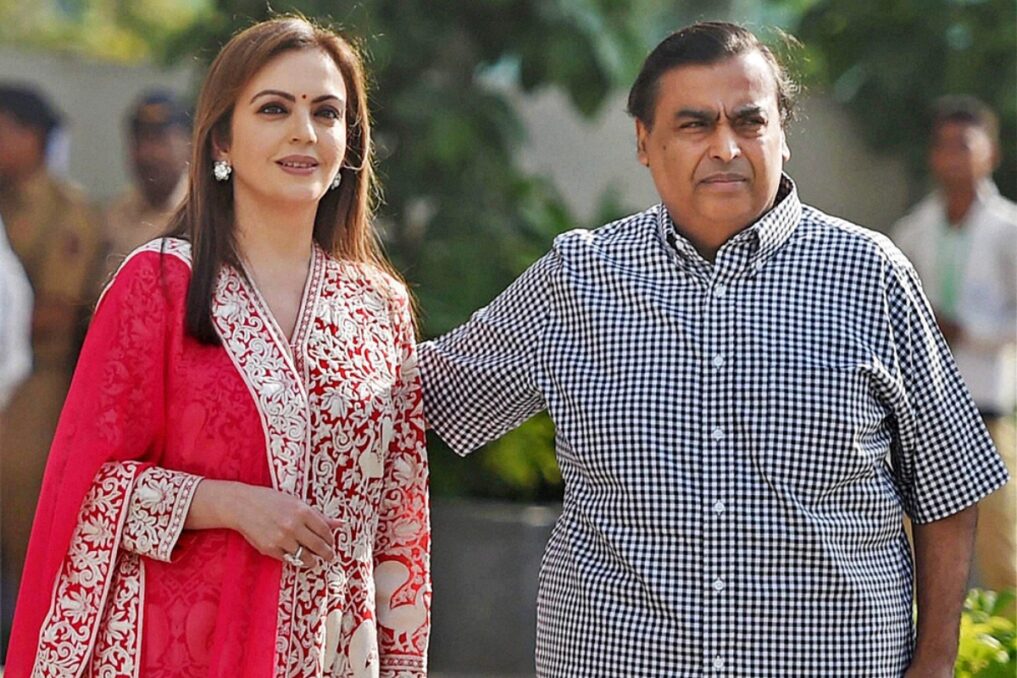

Reliance Retail Ventures, a company of Reliance Industries, which is owned and headed by Indian tycoon Mukesh Ambani is set to receive an investment of 82.7 billion rupees ($1 billion) made by The Qatar Investment Authority.

Table of Contents

Reliance Retail

On Forbes Asia’s compilation of India’s 100 Richest, which was published in October 2022, Ambani was listed as No. 2. He is the chairman and CEO of Reliance Industries, which generated $110 billion in sales during the 2022–23 fiscal year. The company is involved in oil and gas, petroleum-based products, and telecoms in conjunction with retail. The biggest retailer in India, Reliance Retail, continues to work with numerous international companies to establish and grow their businesses in India, including Burberry, Pret A Manger, and Tiffany.

In 2020, it had previously received $5.72 billion from a minimum of six investors, notably KKR and General Atlantic, the Saudi Public Investment Fund, and Mubadala of the United Arab Emirates.

Press Release

In accordance with a press statement issued by QIA on Wednesday, the investment will be transformed into a 0.99% share in unlisted Reliance Retail on an entirely leveraged structure, valuing the Indian company at about $100 billion.

According to Reliance Retailing Ventures, it administers India’s most expansive commercial network, with 18,040 outlets in over 7,000 locations and a total retail area of 65.6 million square feet as of the final week of March. For the fiscal year that concluded in March, the corporation announced revenue of 2.6 trillion rupees ($31.7 billion), a rise of thirty per cent over the corresponding period last year.

In accordance with the press release from Mansoor Ebrahim Al-Mahmoud, CEO of QIA, “QIA adheres to assisting cutting-edge businesses with rapidly expanding prospects in India’s rapidly multiplying retail industry.”

Isha Mukesh Ambani, director of Reliance Retail had recently stated in an announcement: “We are looking forward to the prospect of gaining from QIA’s extensive international expertise and outstanding demonstrated track record of generating value as we continue to evolve Reliance Retail Ventures towards becoming an among the finest entity, enabling revolution in the Indian retail market.”

Reliance Retail has not yet released any information on its plans to schedule, despite various media speculation to that effect. Ambani announced Jio Financial Services, the organization’s collapsed financial business division, previously in August.

Financial Plans

Mansoor Ebrahim Al-Mahmoud, CEO of QIA, said, “We are eagerly looking ahead to Reliance Retail Ventures Limited integrating our steadily expanding and broad portfolio of investments in India thanks to its visionary leadership and extraordinary development profile.

Based on Global SWF, an index of foreign sovereign wealth funds, the $445 billion sovereign financial fund’s direct investments in India have been primarily focused on venture capital funding, especially in digital retail, involving food pickup young companies Swiggy and Rebel Foods in addition to e-commerce platform Flipkart.

Reliance Retail Ventures received financial counsel from Morgan Stanley, and Reliance Industries received process and deal structuring advice from Goldman Sachs.

Robust revenue streams, the flexibility to invest in growing companies, and potential value unlocking in the medium term unlocking in the medium term make RIL an attractive investment in the long term. With energy fueling FY24 and a probable customer rebound in FY25, we think the RIL operational profit reduction pattern may be over. From FY25, Jio+Retail capex could drastically decrease regardless of earnings increase. Beyond results, we think significant value-unlocking through stake sales, IPOs, and listing could significantly influence stock price over the next two to three years,” wrote JPMorgan analysts in an article published this month, available through S&P Global Market Intelligence.