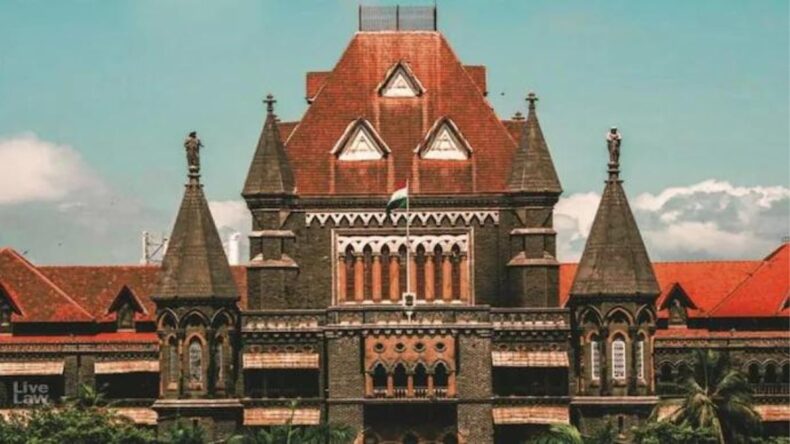

In a recent ruling, The Bombay High Court exempted foreign institutional investors (FII) in Singapore from capital gains tax. The court observed that the Singapore authorities have certified that the capital gains income would be taxed in Singapore, regardless of the amount remitted or received in the country.

Background of the Case

In this instance, the Securities and Exchange Board of India (SEBI) had an assessee who was registered as a FII in the debt category. During the financial year 2010-2011 assessment, the assessee filed its income tax return, declaring a total income of Rs. 33,99,75,350. The assessee claimed a capital gains exemption under Article 13(4) of the India-Singapore Double Taxation Avoidance Agreement (DTAA) for the sale of debt instruments.

The AO’s Rejection and Assessee’s Contention

During the assessment process, the Assessing Officer (AO) questioned the assessee about compliance with Article 24 of the DTAA, which pertains to claiming capital gains exemption in India. The assessee argued that as an FII, it was liable to be taxed on its worldwide income in Singapore. The Singapore Revenue Authority also confirmed this taxation through an April 4, 2012 certificate.

The assessee further emphasized that if it offered its worldwide income for taxation in Singapore, the remittance of such income to Singapore would have no relevance for claiming benefits under the DTAA. However, the AO disregarded the certificate from the Singapore tax authority and interpreted Singapore’s laws independently.

Court’s Observations and Decision

The High Court disagreed with the AO’s interpretation and sided with the assessee. It noted that the limitation of relief under Article 24 of the DTAA would only apply when the entire capital gain is taxed in Singapore on the remitted amount, rather than the entire amount, regardless of remittance. The court highlighted that the Singapore authorities certified that income derived from buying or selling Indian debt securities and foreign exchange transactions in India would be considered as accruing in or derived from Singapore under Singapore tax laws. Therefore, such income would be taxed in Singapore without referencing the amounts remitted or received in the country, rendering the limitation under Article 24 irrelevant.

The court relied on Circular No. 789 dated April 13, 2000, which pertained to the Indo-Mauritius Double Tax Avoidance Convention. Though this circular specifically addressed certificates of residence, its underlying principle was deemed applicable to the present case. According to the court, certificates issued by the Singapore Tax Authorities should be accepted as sufficient evidence to support the legal position.

Conclusion

The Bombay High Court’s decision to grant capital gains exemption to Foreign Institutional Investors (FII) in Singapore carries significant implications for tax matters involving capital gains in India. The court’s ruling emphasizes the importance of recognizing certifications issued by foreign tax authorities and aligning with the principles outlined in relevant double tax avoidance agreements. This case sets a precedent for future disputes concerning capital gains taxation for FIIs and reinforces the need for a comprehensive understanding of international tax laws and agreements.

The High Court’s judgment also promotes certainty and consistency in taxation matters, as it recognizes foreign tax authorities’ authority and expertise in determining investors’ tax liability. By accepting the certification provided by the Singapore Tax Authorities, the court has paved the way for a more streamlined and efficient process of assessing capital gains exemptions for FIIs in Singapore.

Furthermore, this ruling reaffirms the commitment of the judiciary to interpret and apply tax laws fairly and equitably, considering the intent and purpose behind international agreements. It sends a positive message to foreign investors and reinforces the notion that India is committed to fostering a favorable investment climate, while also ensuring the integrity of its tax system.

Case Title: CIT Versus M/s Citicorp Investment Bank