Bitcoin- Cryptocurrency Markets major virtual trading platform returned to the blue on Thursday after altcoins were not mentioned in the SEC’s lawsuit against Binance and Coinbase earlier this week.

Table of Contents

Introduction:

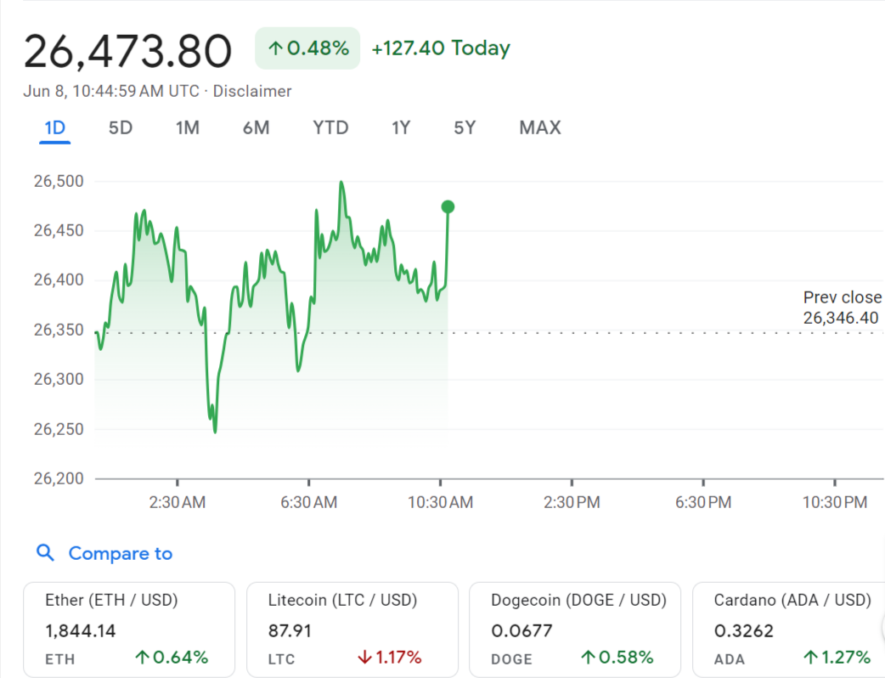

The famous dynamic cryptocurrency markets faced a major drop today as the original Bitcoin asset fell below the $26,500 mark. Binance Coin and Solana (SOL) are also losing over 6%.

In this article, we explore the factors that contributed to this price correction and explore their implications for the broader crypto space.

Bitcoin Drops:

Bitcoin, often regarded as the pioneer of the cryptocurrency markets struggled today as it fell below the key support level of $26,500.

Given the stability and gradual recovery seen in the crypto space recently, this drop may come as a surprise to many market participants.

While the actual catalysts for this downtrend are diverse and often difficult to pinpoint, several factors may have contributed to the decline.

Crypto Markets Outlook and Global Trends:

The cryptocurrency market is vulnerable to changes in market sentiment and the overall market. Concerns about global economic stability, financial stress, and regulatory uncertainty could weigh on investor confidence, leading to sales. The recent drop in Bitcoin prices seems to reflect this concern.

Research and Support Analysis Value:

Technical analysis work is critical for understanding the market, and traders pay attention to the importance of support and resistance levels.

A break below the $26,500 support level could stimulate a selling wave as traders may take it as a bearish signal, which could lead to further declines in bitcoin prices.

Comparison of changes in the prices of Bitcoin w.r.t other virtual currencies.

Source: coinmarketcap.com

Impact of Cryptocurrency Markets on Altcoins: BNB and Solana:

The price correction also affected the altcoin market, with Binance Coin (BNB) and Solana (SOL) suffering massive losses of over 6%. BNB, the legacy token of the Binance ecosystem, has seen tremendous growth in recent months. However, today’s drop shows the weakness of altcoins and their dependence on the overall market sentiment and goal completion of major cryptocurrencies like Bitcoin.

Solana is the most successful blockchain platform and has gained a lot of attention and popularity due to its robustness and solid ecosystem. Despite its significant promise, Solana’s price has become a stumbling block in today’s market. It is a reminder that even strong projects have wild price swings in an unpredictable and uncertain market.

Cryptocurrency Market:

The cryptocurrency market has inherent volatility, and price changes are expected. While these dips can be devastating, it’s important to take care of them in the long run. Crypto markets have proven that they can work again, recover from setbacks, and set new highs every time.

Investors and traders are advised to use caution, do extensive research, and make informed decisions based on their own risk tolerance and investment goals.

A diversified and balanced mix of different cryptocurrencies can help mitigate the effects of rapid fluctuations.

- For example, diversifying into different currencies with different applications is not recommended unless the investment value is dependent on the underlying asset. for example: Using Tether and USD coins – a stable currency with a normal value to eliminate the fluctuations in the crypto market.

- Additionally, investments can be made in different encrypted blockchains, such as Cardano (ADA), based on security, scalability, and efficiency. Other types of blockchain include the EOS blockchain, which runs on web services, including cloud storage and developer applications.

- In addition, individuals can distribute their cryptocurrency investments through capital markets. Also, while there is more stability among large-volume cryptocurrencies like Bitcoin, growth potential is higher for small-volume cryptocurrencies. For instance, with a market cap of $1.3 billion, Kusama is a cryptocurrency with great potential.

Regulatory Environment and Investor Safeguards:

The regulatory environment surrounding cryptocurrencies is constantly changing as governments around the world struggle to develop systems to regulate existing assets. Announcements and compliance will have an impact on business sentiment and value.

As the cryptocurrency market grows, transparency and investor protection are crucial to fostering trust and security. Transparent rules help reduce market manipulation and fraud by providing a safer and more reliable environment for market participants.

Conclusion:

Today’s price correction shows the uncertainty in the cryptocurrency market, with Bitcoin falling below $26,500 and BNB and Solana falling more than 6%.

While the exact nature of this decline is difficult to determine, factors such as market sentiment, international events, audits, and regulatory developments can all contribute to these price pressures.

Crypto investors and enthusiasts should keep in mind that the market downturn is part of this rapid growth. By maintaining a long-term perspective, exercising due diligence, and being aware of fundamental principles and good business practices, individuals can approach the cryptocurrency space with confidence.